EB-5 Visa:

U.S. Residency

for Investors.

The EB-5 Visa provides U.S. residency for investors who create jobs through qualifying business investments.

Investors from all over the world choose the EB-5 Visa because it doesn’t require sponsorship. Plus, you can live anywhere in the U.S. once your green card is approved.

Direct Green Card

Gain permanent residency

through investment.

No Sponsorship

No need for employer

or family sponsorship.

Family Benefits

Green cards for

spouse and children.

Business Choice

Invest in various industries

and locations.

Passive Investment

No business experience required

with Regional Centers.

Client

Satisfaction

Years

in the business

EB-5 Visa:

What Every Investor Needs to Know

The EB-5 Visa program is an attractive U.S. immigration option for global investors. It provides a pathway to a green card through capital investment in U.S. businesses, leading to economic growth and job creation. This visa offers substantial benefits for high-net-worth individuals looking to secure permanent residency for themselves and their families.

This guide will walk you through everything you need to know about the EB-5 Visa program, from basic requirements to understanding investment options, all optimized for SEO and investor clarity.

Overview of the EB-5 Immigrant Investor Program

The EB-5 Immigrant Investor Program was established by the U.S. Congress in 1990 to stimulate economic growth through foreign investment. Under the program, investors must make a capital investment in a U.S. commercial enterprise and create or preserve a minimum of 10 jobs for U.S. workers.

EB-5 investors receive a conditional green card, which can become permanent after fulfilling the program’s requirements.

Key Elements of the EB-5 Program:

- Minimum investment of $800,000 or $1.05 million, depending on the location.

- Job creation requirement: 10 full-time jobs for U.S. workers.

- Investment in either a new commercial enterprise or a regional center project.

EB-5 Visa Success Rate.

The success rate of the EB-5 Visa has been generally high, with over 90% of applicants being approved in recent years.

00%

Depending on

the U.S. business

EB5 Visa Application Costs and Processing Timeline

An overview of fees and processing times for applying to the EB5 Visa program, intended for investors making substantial capital investments in U.S. commercial enterprises.

Application Fees

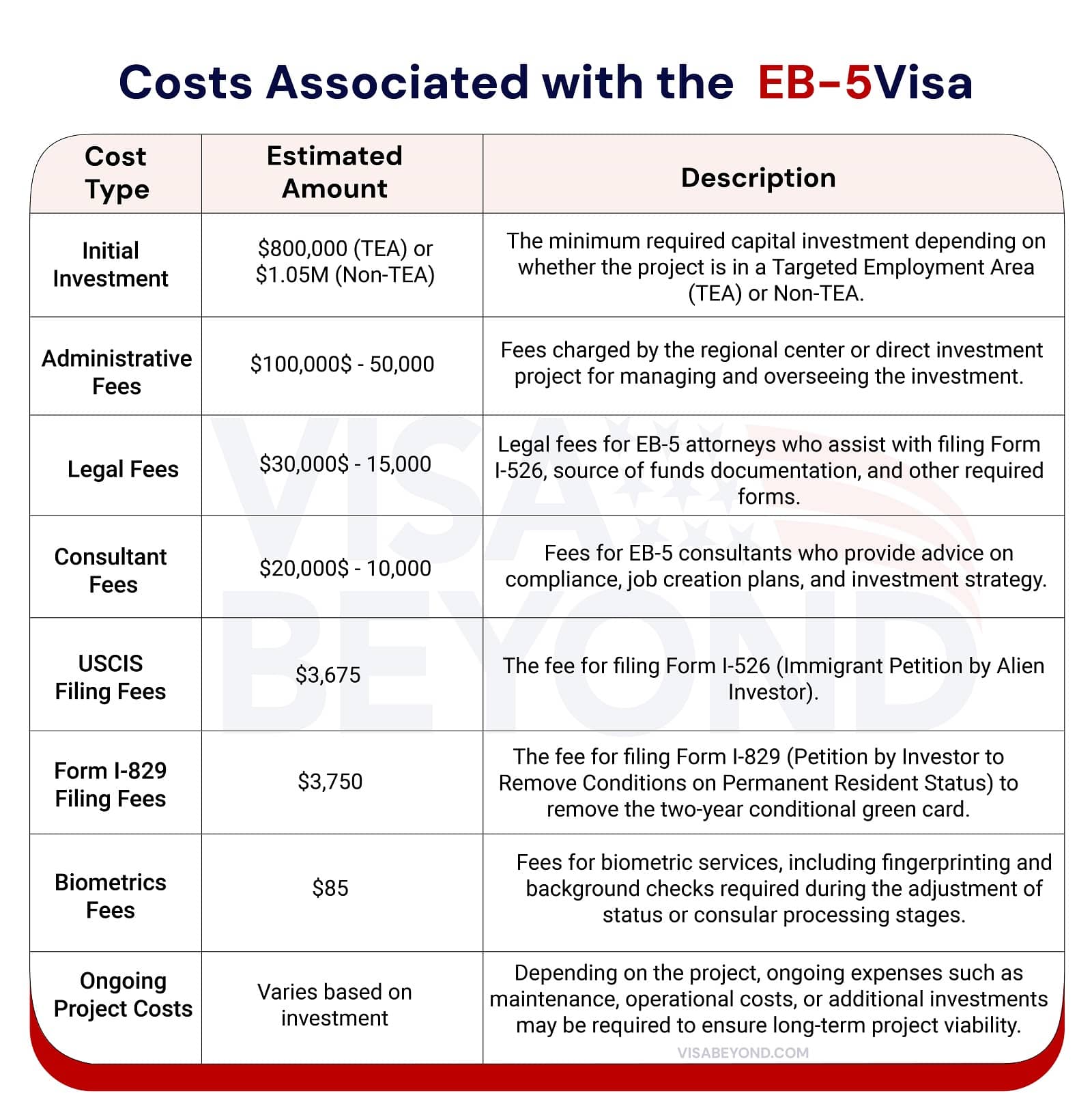

- Form I-526 Filing Fee: $3,675

- Form I-485 Filing Fee: $1,140

- Biometrics Fee: $85

- Visa Issuance Fee: Varies by country

- Premium Processing Fee: Currently not available for EB5 petitions.

Application Timeline

- Form I-526 Processing: 24 to 52 months

- Adjustment of Status Processing: 8 to 14 months for Form I-485.

FAQs

About EB-5 Visa.

Can I get U.S. citizenship through the EB-5 Visa?

Yes, after holding a green card for 5 years, EB-5 investors can apply for U.S. citizenship.

Can my family get green cards with my EB-5 investment?

Yes, your spouse and unmarried children under 21 can obtain green cards through your EB-5 investment.

Is there a limit on how many EB-5 Visas are issued each year?

Yes, there is an annual limit of approximately 10,000 EB-5 Visas, including for family members of the investor.

Do I need to speak English to apply for the EB-5 Visa?

There is no language requirement for the EB-5 Visa, but it may help in managing your investment if you’re doing a direct business.

How many jobs must be created for an EB-5 Visa?

You must create at least 10 full-time jobs for U.S. workers as part of your EB-5 investment.

What is a Regional Center in the EB-5 program?

A Regional Center is an organization that manages EB-5 investments, allowing investors to pool funds into larger projects with indirect job creation benefits.

Can I live anywhere in the U.S. with an EB-5 Visa?

Yes, once you receive your green card, you can live anywhere in the U.S., regardless of where your investment is located.

Clients we

work for.

Why the U.S. EB-5 Visa is a Top Choice for U.S. Immigration

The EB-5 Visa stands out from other U.S. immigration programs due to its relatively straightforward path to permanent residency. Unlike other visa programs, which may require specific skills, employer sponsorship, or family connections, the EB-5 Visa relies purely on investment and job creation.

Example:

A foreign investor seeking residency in the U.S. can invest in a hotel project within a Targeted Employment Area (TEA), and after the project creates the required jobs, they and their family may be eligible for green cards.

Benefits for Investors:

- No need for employer sponsorship or specific skill set.

- Direct path to U.S. residency for the investor, their spouse, and unmarried children under 21.

Advantages of the EB-5 Visa for Investors Over Other U.S. Visas

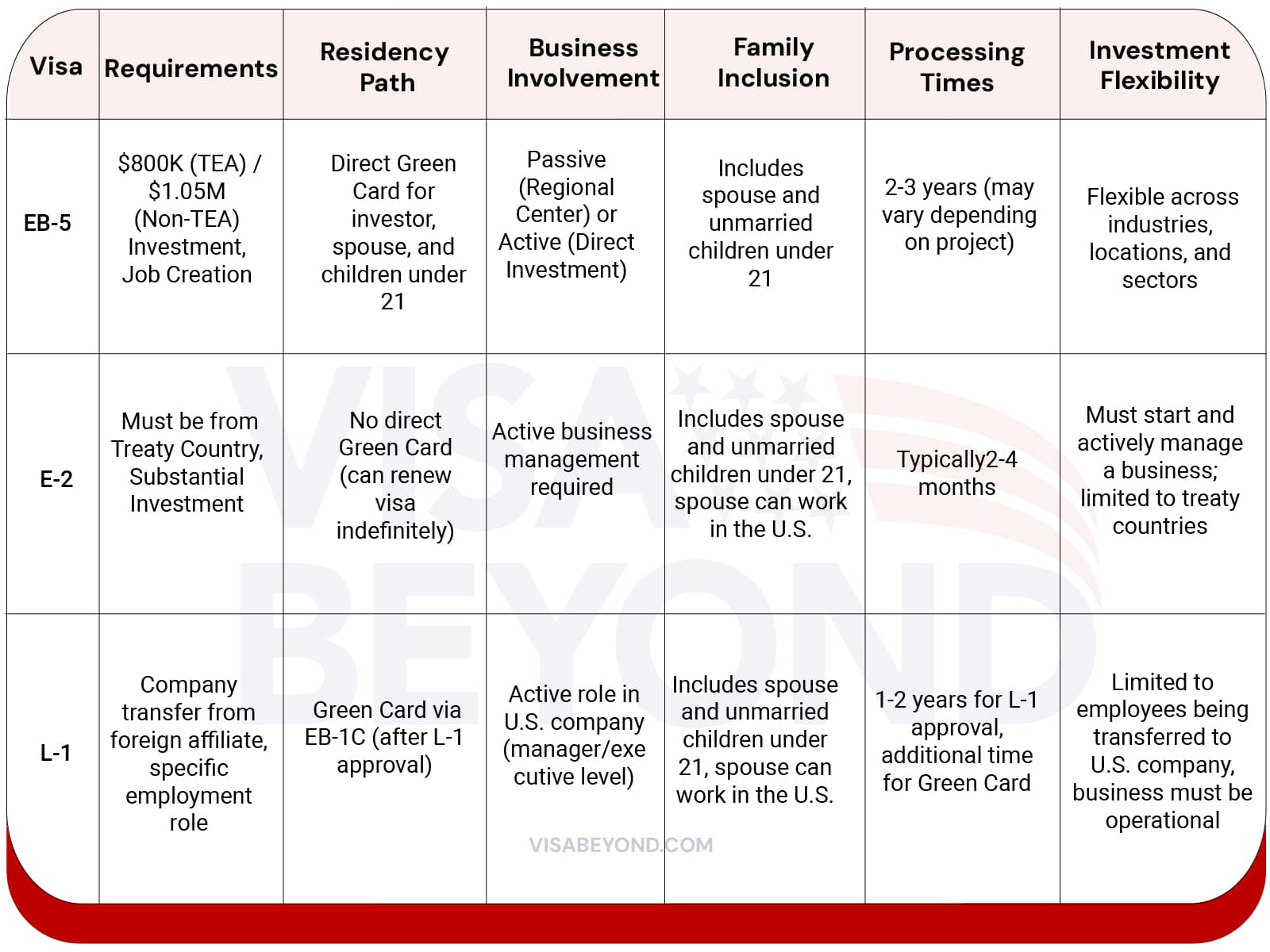

Investors considering the EB-5 Visa should understand how it compares to other visa options like the E-2 or L-1. Here’s a quick comparison:

Benefits of the EB-5 Visa for Entrepreneurs and Investors

The EB-5 Visa offers multiple advantages for entrepreneurs looking to expand into the U.S. market:

- Access to U.S. Market: Entrepreneurs can launch businesses in the world’s largest economy with fewer restrictions.

- Permanent Residency: Investors and their families can secure permanent residency, with the potential for citizenship.

- No Day-to-Day Management Required: For those using regional centers, you can invest without needing to manage the business daily.

Scenario:

An entrepreneur could invest $1.05 million in a new real estate project while continuing to run their primary business abroad. They fulfill their investment requirements, and after two years, the family becomes permanent residents of the U.S.

Who Qualifies for the EB-5 Visa?

Not every investor qualifies for the EB-5 Visa. To be eligible, the investor must meet certain financial, legal, and employment requirements.

Eligibility Requirements for Investors

- Minimum Investment: Either $800,000 in a TEA or $1.05 million in other areas.

- Job Creation: The investment must create at least 10 full-time jobs for U.S. workers.

- Lawful Source of Funds: Investors must prove that their investment capital comes from lawful sources.

Background Checks and Legal Documentation Needed

The investor and their family must undergo background checks, including:

- Source of funds documentation.

- Proof of job creation.

- Completion of Form I-526 (Immigrant Petition by Alien Investor).

Documentation needs to be thorough to avoid delays in processing.

EB-5 Visa Requirements and Investment Options for Entrepreneurs

The EB-5 Visa offers flexibility for entrepreneurs looking to invest in the U.S. There are various ways to meet the requirements based on your business preferences.

Minimum Investment Amount for EB-5 Visa

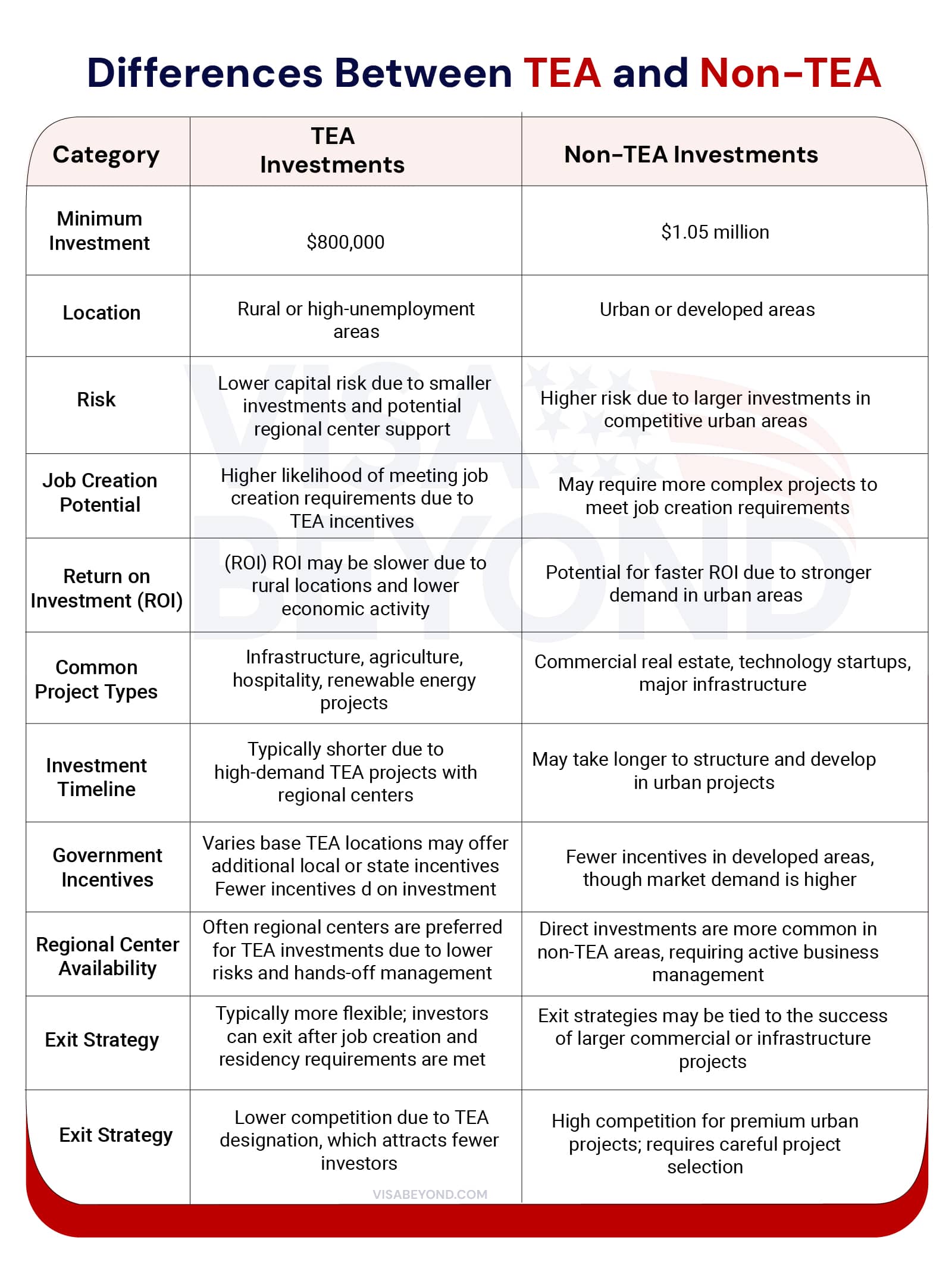

The minimum investment amount required depends on the location of the project:

- $800,000 for investments in a Targeted Employment Area (TEA), which is either a rural area or an area with high unemployment.

- $1.05 million for investments outside of TEAs.

Example:

If you invest in a rural area, the minimum threshold is lower, which can be an attractive option for entrepreneurs interested in starting businesses in less populated regions.

Current Investment Thresholds and Updates

The minimum investment amounts for the EB-5 Visa were recently adjusted in 2022:

- TEA Investment: $800,000

- Non-TEA Investment: $1.05 million

These amounts are expected to be adjusted periodically based on inflation and economic changes.

Targeted Employment Area (TEA) Investment Options

Investing in a TEA offers a lower investment threshold, making it a more accessible option for investors. TEAs are generally rural or high-unemployment areas. These areas often have regional centers that allow for more passive investment.

Advantages of TEA Investments:

- Lower investment amount ($800,000).

- Potentially higher job creation due to economic incentives in these areas.

Differences Between TEA and Non-TEA Investments

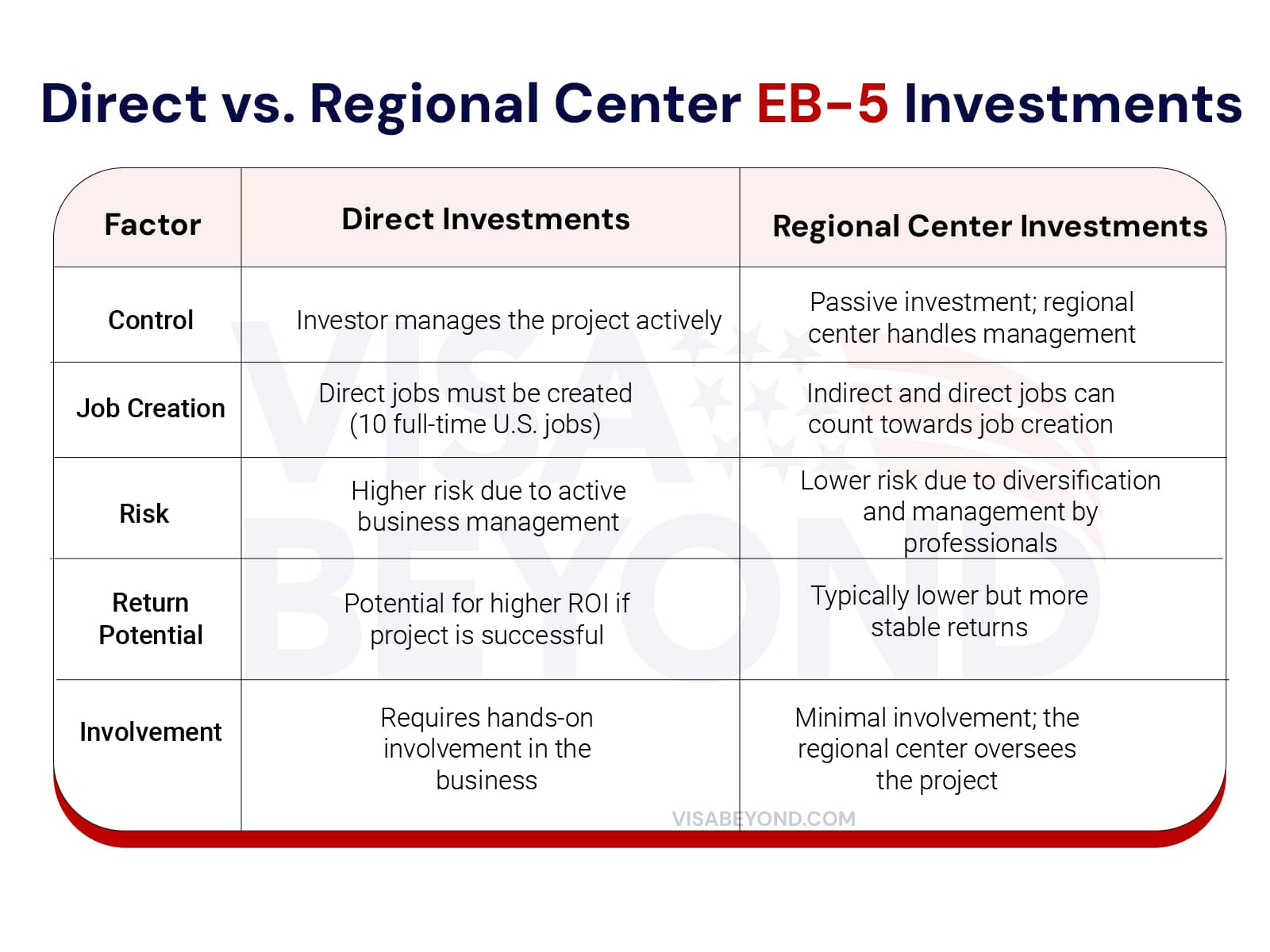

Direct vs. Regional Center EB-5 Investments: Key Differences

When considering the EB-5 Visa, investors have two main paths: Direct Investments and Regional Center Investments. Each option offers distinct benefits and potential risks. The decision often depends on the investor’s preferences for control, involvement, and risk tolerance.

Understanding Direct EB-5 Investments for Entrepreneurs

For investors who prefer more control over their funds, direct EB-5 investments can be an attractive option. In this model, the investor actively manages a business that directly creates 10 full-time U.S. jobs. This approach allows entrepreneurs to own and operate their own ventures, often in industries like hospitality, healthcare, or technology.

Example:

An investor could open a chain of restaurants in a metropolitan area, managing the business day-to-day while meeting the job creation requirements. This offers the potential for higher returns but also requires greater involvement and risk.

Regional Center Investments: Benefits and Risks for Investors

Regional Center Investments allow investors to take a more hands-off approach. Regional centers pool EB-5 funds from multiple investors and manage large-scale projects, such as real estate developments or infrastructure projects. These investments can include both direct and indirect job creation, giving investors more flexibility.

Benefits:

- Lower involvement: The regional center manages the business and ensures compliance with EB-5 regulations.

- Diversified projects: Investments are spread across larger projects, reducing individual risk.

- Job creation flexibility: Indirect job creation counts, making it easier to meet EB-5 requirements.

Risks:

- Lower returns: Because regional centers often focus on stable, lower-risk projects, the returns may be lower than direct investments.

- Dependence on the regional center: Investors rely on the regional center’s ability to manage the project and meet job creation goals.

Risk Management Strategies for Regional Center Investments

Investing through a regional center offers advantages, but investors need to manage risks carefully. Here are some risk management strategies:

- Diversification: Choose a regional center that invests in a variety of sectors to spread risk across multiple projects.

- Research Project Track Records: Investigate the success of past projects managed by the regional center.

- Monitor Job Creation: Ensure the project has a robust plan for job creation and that indirect job calculations are credible.

- Review Financial Statements: Request and review the financial health of the project and the regional center.

Top Regional Centers for EB-5 Visa Investors

Some of the top regional centers with a track record of success include:

Conducting Due Diligence on EB-5 Regional Centers

Before investing, it’s critical to conduct due diligence to ensure the regional center is reputable and has a strong track record. Investors should:

- Examine the regional center’s USCIS approval status.

- Review the track record of completed EB-5 projects to ensure job creation and successful investor outcomes.

- Request detailed project financials to evaluate the potential for ROI and job creation.

Checklist for Evaluating Regional Centers

Here’s a quick checklist to use when evaluating potential regional centers:

USCIS Approval:

Is the regional center in good standing with USCIS?

Past Project Success:

Has the regional center successfully completed projects with full job creation?

Financial Transparency:

Are project financials accessible and easy to understand?

Management Team Experience:

Does the regional center have experienced leadership in managing EB-5 investments?

Exit Strategy:

What are the timelines and options for exiting the investment?

EB-5 Visa Application Process

The EB-5 visa application process is detailed but can be navigated successfully with the right preparation. Investors must file various forms, provide documentation of their investment, and follow USCIS guidelines carefully.

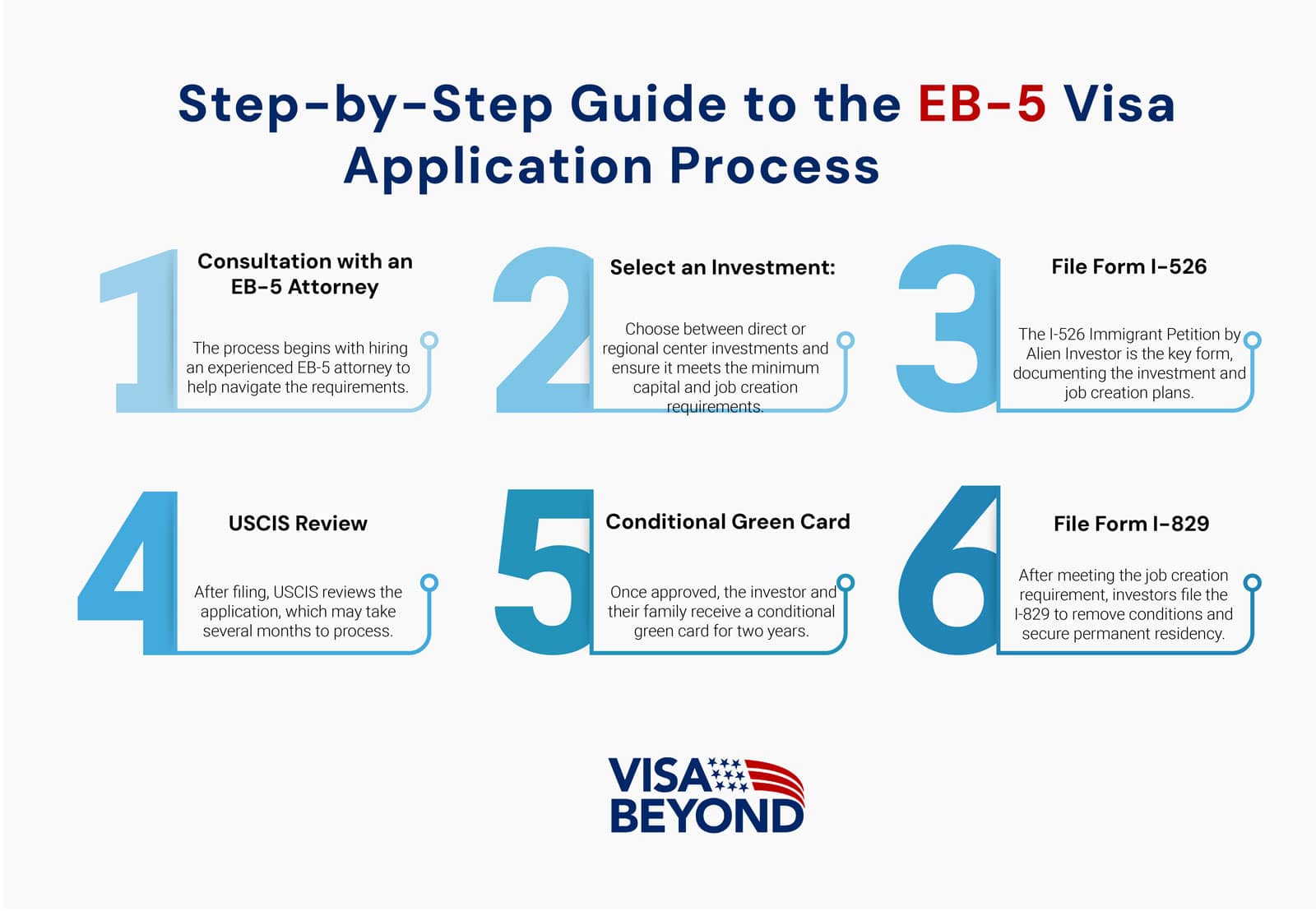

Step-by-Step Guide to the EB-5 Visa Application Process

- Consultation with an EB-5 Attorney: The process begins with hiring an experienced EB-5 attorney to help navigate the requirements.

- Select an Investment: Choose between direct or regional center investments and ensure it meets the minimum capital and job creation requirements.

- File Form I-526: The I-526 Immigrant Petition by Alien Investor is the key form, documenting the investment and job creation plans.

- USCIS Review: After filing, USCIS reviews the application, which may take several months to process.

- Conditional Green Card: Once approved, the investor and their family receive a conditional green card for two years.

- File Form I-829: After meeting the job creation requirement, investors file the I-829 to remove conditions and secure permanent residency.

Preparing Documentation and Filing Form I-526

Form I-526 is the foundational document that investors must submit to begin the EB-5 visa process. It demonstrates that the investor meets all the financial and job creation requirements of the program. Filing this form requires thorough preparation and detailed documentation to ensure a smooth review by USCIS.

Key Documentation Requirements:

Source of Funds:

Investors must provide clear evidence that the capital being invested was legally obtained. This includes bank statements, tax returns, sales of assets, business profits, and gifts, all clearly showing the lawful source of the funds.

Example: An investor selling a business to fund their EB-5 investment must provide the sale contract, bank transfer records, and related tax documents to show the legitimacy of the funds.

Investment Structure:

This section outlines the business or project where the investment will be made, whether it’s through a regional center or direct investment. Investors need to provide financial projections, project plans, and detailed information on how the capital will be used.

Example: In a real estate development project, the investor would need to provide documentation on land purchases, construction costs, and expected revenues.

Job Creation Plan:

The I-526 form must include a detailed plan showing how the investment will create at least 10 full-time jobs for U.S. workers. This can be direct (through direct hiring) or indirect (through economic activity spurred by the project).

Example: For a hotel project, the plan would include hiring projections for hotel staff, as well as jobs created indirectly through construction and suppliers.

Common Mistakes to Avoid When Filing EB-5 Applications

Filing for an EB-5 visa is a complex process, and even minor mistakes can lead to costly delays or denials. Here are some common mistakes that investors should avoid when preparing their application:

Insufficient Job Creation Documentation:

A weak or vague job creation plan can result in USCIS questioning whether the investment will meet the EB-5 program’s requirements. Investors should provide detailed, realistic plans with timelines and positions that align with USCIS guidelines.

Avoid: Submitting job creation estimates without supporting data, such as industry studies or economic models.

Incomplete Source of Funds Proof:

Every dollar invested must be fully traceable to a lawful source. Failure to provide sufficient documentation can lead to application denial. It’s essential to have thorough financial records, including proof of transfers and asset sales.

Avoid: Relying on incomplete tax records or failing to trace all sources of capital.

Poor Investment Choice:

Investing in a risky project without a solid business plan or job creation strategy can lead to failed investments, jeopardizing both the capital and the visa approval. It’s crucial to choose reputable regional centers or business ventures with a track record of success.

Avoid: Choosing a project without performing proper due diligence or selecting one with a history of job creation failures.

Consular Processing and Adjustment of Status for EB-5 Investors

Once an investor’s I-526 petition is approved, they have two options to proceed toward obtaining their green card: consular processing or adjustment of status. The choice between the two depends on whether the investor is already residing in the U.S. or abroad.

Filing Form I-485:

Investors must submit Form I-485, the Application to Register Permanent Residence or Adjust Status. This form requires evidence of the approved I-526 petition, along with personal information about the investor and their family.

Attending a Biometrics Appointment:

Once the I-485 form is filed, USCIS will schedule a biometrics appointment for the investor, where fingerprints and photos will be taken. This step ensures that the applicant passes security checks.

Receiving a Conditional Green Card:

If USCIS approves the adjustment of status, the investor and their family will receive a two-year conditional green card. During this period, they must fulfill the job creation requirement to apply for permanent residency.

Consular Processing: What to Expect

For investors living abroad, the consular processing procedure involves several key steps:

- Scheduling an Interview:

After the I-526 petition is approved, investors will be asked to schedule an interview at the U.S. embassy or consulate in their home country. This interview will focus on verifying the investment details and ensuring that all visa requirements are met. - Submitting Required Documents:

Investors must bring a variety of documents to the consular interview, including financial records, investment proof, and job creation plans. This ensures that the investment is legitimate and meets EB-5 standards. - Receiving the EB-5 Visa:

After the consular interview, if all requirements are satisfied, the investor will be granted an EB-5 visa to enter the U.S. as a conditional permanent resident. Upon entry, the two-year conditional residency period begins, during which job creation must be completed.

Crafting a Successful EB-5 Visa Business Plan

A well-crafted EB-5 Visa business plan is one of the most crucial elements of the EB-5 application process. It demonstrates how the investor’s capital will be used, how jobs will be created, and ensures compliance with USCIS guidelines. A successful business plan is detailed, well-researched, and structured to support the investment’s goals and long-term sustainability.

Whether you’re investing in a new enterprise or through a regional center, your business plan must convincingly outline how your investment will create the required jobs and generate returns, which makes proper preparation essential.

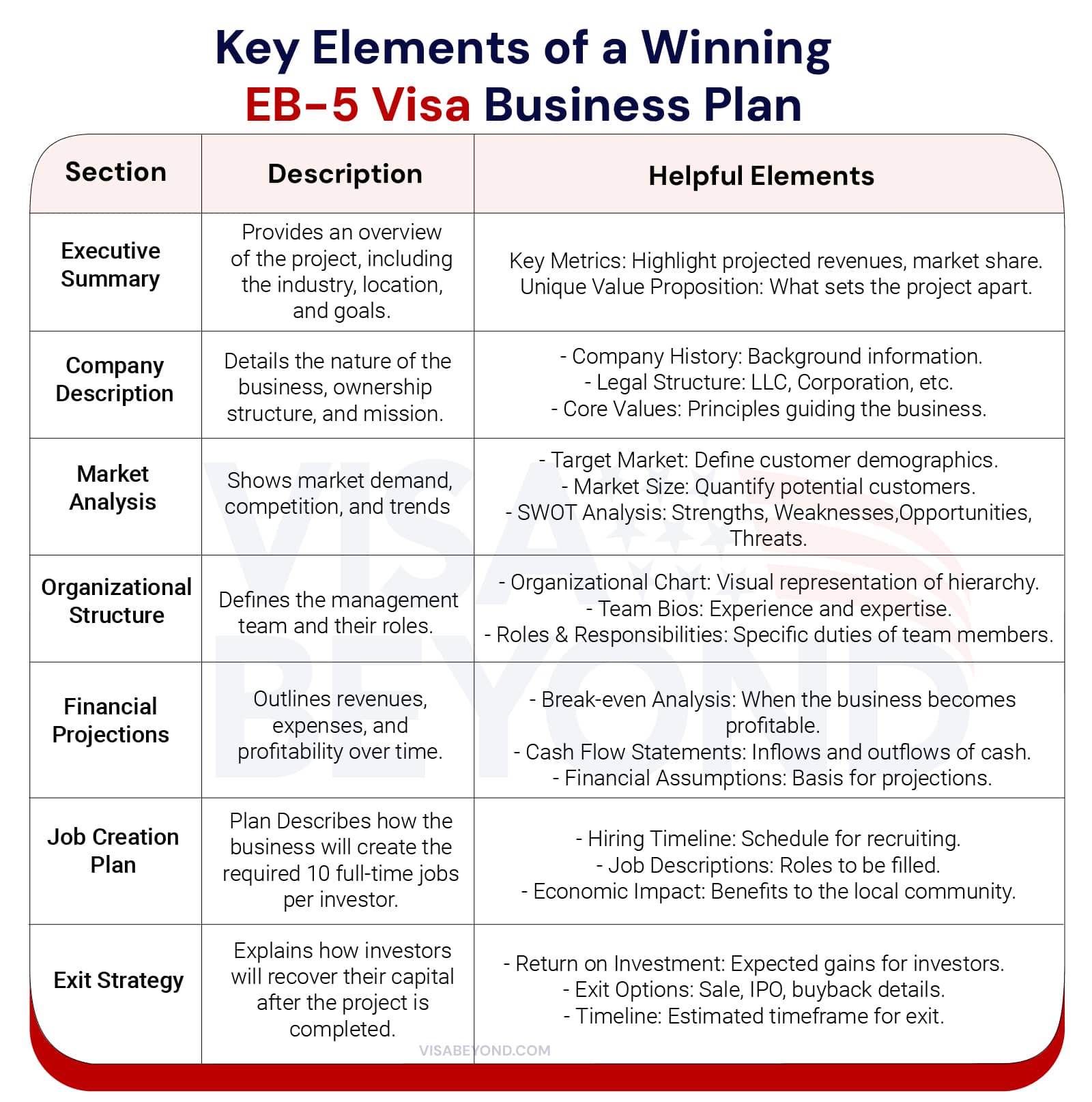

Key Elements of a Winning EB-5 Visa Business Plan

A robust and detailed business plan is essential for a smooth EB-5 visa approval process. An EB-5 business plan must meet specific requirements to be USCIS-compliant. Here are the key elements that should be included:

Market Research and Financial Projections for EB-5 Business Plans

Strong market research and financial projections are essential components of an EB-5 business plan. These elements help demonstrate the viability of the project and how it will contribute to the U.S. economy.

Market Research:

Investors should include data about the industry, competitors, market demand, and growth potential. This research proves that the investment is sound and that there’s a strong market for the business.

Example: For a hospitality project, include statistics on tourism in the project area, competition analysis, and projected growth in the local hotel industry.

Financial Projections:

Provide detailed financial forecasts for the next five years, including profit and loss statements, cash flow projections, and balance sheets. These projections should illustrate how the project will generate revenue and meet its financial goals.

Pro Tip: Use conservative estimates in your projections to avoid overstating profitability.

Legal and Compliance Considerations for EB-5 Business Plans

To avoid delays or rejections, an EB-5 business plan must comply with USCIS requirements. The plan must clearly explain:

- Ownership Structure: How the investor fits into the ownership and management of the business.

- Use of Funds: A detailed breakdown of how the EB-5 capital will be used, ensuring that it is aligned with USCIS rules.

- Job Creation: The plan should include specific details on how 10 full-time jobs will be created for U.S. workers. Projects that do not meet this requirement may be rejected.

- Regional Center Compliance (if applicable): Ensure that the plan follows the regional center’s specific guidelines and job creation strategies if investing through one.

Common Pitfalls in EB-5 Business Plans

Avoiding common mistakes can significantly increase the chances of your EB-5 business plan being approved. Some common pitfalls include:

- Overly Optimistic Financial Projections: Inflated revenue and profitability projections may raise red flags for USCIS, leading to delays or denials.

- Vague Job Creation Plans: Failing to provide a clear, step-by-step plan for how jobs will be created can result in application rejection.

- Insufficient Market Research: Not providing detailed market analysis can make it difficult to prove the project’s viability and potential for success.

How to Create Job Projections for EB-5 Business Plans

A key requirement of the EB-5 Visa is to create 10 full-time jobs per investor, making job projections an essential part of the business plan. Here’s how to create a strong job projection:

- Direct Job Creation: Identify positions that will be directly created by the business, such as managers, administrative staff, or laborers. These must be full-time jobs.

- Indirect Job Creation: For regional center projects, include jobs created indirectly through economic impact, such as construction workers hired by contractors or suppliers.

Example: A hotel project may create direct jobs for hotel staff, but it could also create indirect jobs for construction workers during the building phase. - Timeline: Provide a timeline for when these jobs will be created to meet USCIS requirements within the two-year conditional residency period.

Key Metrics for EB-5 Job Creation

The success of an EB-5 investment hinges on job creation. Here are key metrics to focus on:

- Number of Jobs: The business plan must prove the creation of 10 full-time jobs per investor.

- Job Categories: Break down the types of jobs created (e.g., management, administrative, labor).

- Wages and Benefits: Outline the wages and benefits provided to the employees to show long-term employment sustainability.

These metrics should be clear and backed by evidence from market research and the company’s financial projections.

Ensuring Long-Term Job Sustainability for EB-5 Projects

It’s not enough to just create jobs; they must also be sustainable for the long term. To ensure job sustainability:

- Revenue Models: Ensure that the business has reliable revenue streams to support continued employment.

- Long-Term Contracts: Secure contracts or agreements that provide consistent work for employees over time.

- Industry Growth: Choose industries with long-term growth potential, such as healthcare, hospitality, or renewable energy, to ensure the business thrives.

By demonstrating how jobs will be sustained, investors can increase the likelihood of successfully meeting USCIS requirements.

EB-5 Visa Timeline and Costs

The EB-5 Visa timeline and costs can vary based on the type of investment and processing times. Understanding these factors can help investors plan more effectively.

Understanding the EB-5 Visa Processing Times

The EB-5 processing time typically takes 12-24 months or longer, depending on various factors:

- Form I-526 Processing: Filing Form I-526 is the first step and can take 12-18 months for approval.

- Visa Availability: Processing times can vary based on your country of origin. Investors from countries like China and India may face additional delays due to visa backlogs.

- I-829 Filing: After fulfilling job creation requirements, Form I-829 is filed to remove conditions, which can take an additional 6-12 months.

Factors Influencing the EB-5 Visa Timeline

Several factors can influence how long the EB-5 process takes:

- Project Type: Direct investments may require more hands-on management, potentially lengthening the process. Regional centers often have streamlined operations.

- Country of Origin: Investors from countries with high demand, such as China, may experience longer processing times due to visa limits.

- USCIS Workload: Changes in USCIS processing times due to backlogs or staffing issues can impact the overall timeline.

Tips for Expediting Your EB-5 Visa Application

To expedite your EB-5 visa process, consider the following tips:

- Choose a Regional Center with a Proven Track Record: Investing in a regional center with experience in handling EB-5 applications can speed up the process.

- Submit Complete Documentation: Ensure that all required documents are accurate and comprehensive when submitting your I-526 petition to avoid unnecessary delays.

- Engage Experienced Legal and Financial Advisors: Work with professionals who specialize in EB-5 applications to prevent errors and minimize delays.

Costs Associated with the EB-5 Visa

The EB-5 Visa requires a significant financial commitment, including both the initial investment and other associated costs. Investors must be prepared for upfront and ongoing expenses.

EB-5 Visa vs. E-2 Visa: Choosing the Right U.S. Investment Visa

For investors looking to gain U.S. residency through investment, the EB-5 Visa and E-2 Visa are two popular options. While both visas provide access to the U.S., they differ significantly in terms of requirements, residency paths, and business involvement. This section will help you understand the key differences, advantages, and financial commitments of each visa so you can choose the one that best suits your investment goals.

Determining Your U.S. Investment Visa Needs

Choosing the right investment visa depends on your long-term goals, business involvement preferences, and financial capabilities. Here’s a breakdown to help you determine which visa is right for you:

Do you want a direct path to U.S. residency?

The EB-5 Visa offers a clear path to permanent residency (green card) for you and your family. In contrast, the E-2 Visa does not provide a direct path to a green card but allows indefinite renewals as long as the business is operational.

How actively do you want to manage your business?

If you prefer a hands-off approach, the EB-5 Visa, especially through regional center investments, allows you to invest in projects managed by others. On the other hand, the E-2 Visa requires active management of a U.S.-based business.

What is your budget for investment?

The EB-5 Visa requires a significant financial commitment (minimum $800,000 or $1.05 million), while the E-2 Visa can be obtained with a "substantial investment," often starting around $100,000.

Example Scenario:

If you’re looking to permanently reside in the U.S. and have substantial capital to invest, the EB-5 Visa may be the better option. However, if you want to actively manage a business and aren’t ready for a long-term residency commitment, the E-2 Visa could be more suitable.

Long-Term Residency with EB-5 Visa

The EB-5 Visa is particularly attractive for investors seeking long-term U.S. residency. Upon approval, EB-5 investors and their immediate family members (spouse and unmarried children under 21) receive a conditional green card valid for two years. After fulfilling the investment and job creation requirements, they can apply for permanent residency by filing Form I-829, and eventually, U.S. citizenship.

Active Business Management with E-2 Visa

In contrast, an E-2 Visa requires the investor to actively manage their business. The E-2 Visa allows citizens of treaty countries to invest in a U.S.-based business and reside in the U.S. while operating that business. Unlike the EB-5 Visa, which can lead to permanent residency, the E-2 Visa is a non-immigrant visa, meaning it must be renewed as long as the business is operational.

Key Requirements of the E-2 Visa:

Active Business Role:

The investor must play an active role in managing the day-to-day operations of the business.

No Direct Path to Permanent Residency:

E-2 visa holders cannot directly transition to a green card. However, the visa can be renewed indefinitely as long as the business continues to meet visa requirements.

Lower Investment Threshold:

While the exact amount isn’t specified, E-2 investments typically range from $100,000 to $200,000, making it more accessible than the EB-5 Visa.

Example:

If you want to establish a restaurant or retail business in the U.S. and plan to be deeply involved in its operations, the E-2 Visa is ideal.

Comparing Financial Commitments for EB-5 and E-2 Visas

The financial commitments for the EB-5 and E-2 visas differ significantly, both in terms of initial investment and ongoing obligations. Here’s a quick comparison:

- EB-5 Visa: Investors must commit a substantial amount of capital ($800,000 or $1.05M), along with administrative and filing fees.

- E-2 Visa: The required investment varies but is typically lower (around $100,000), though investors must actively manage the business.

Financial Impact Example:

An EB-5 investor who chooses to invest in a regional center project would make an upfront investment and may not have to worry about day-to-day operations, while an E-2 visa holder would need to invest a smaller amount but would have to remain actively involved in their business to keep the visa.

Consulting Experts on EB-5 and E-2 Visa Options

Navigating the complexities of both the EB-5 and E-2 Visa programs can be challenging, which is why consulting with immigration experts and business advisors is highly recommended. Each visa has its own set of requirements, and a well-informed decision can help avoid costly mistakes and delays.

Benefits of Consulting with Experts:

- Tailored Advice: Immigration attorneys can help determine which visa is better suited to your specific goals, whether you’re aiming for long-term residency or business expansion.

- Project Evaluation: Experts can help evaluate business opportunities and ensure your investment aligns with U.S. visa requirements.

- Compliance: Legal experts ensure that your application and business practices are compliant with USCIS standards, reducing the risk of rejection.

Let’s Make Your U.S. Dreams a Reality.

Navigating EB-5 Visa Denials and Rejections

The EB-5 Visa program can be an excellent pathway to U.S. residency, but not all applications are approved. Even with a significant investment, visa denials and rejections can occur due to several factors, from inadequate documentation to non-compliance with USCIS requirements. Understanding the common reasons for denial, how to appeal, and how to avoid pitfalls can significantly increase your chances of success. This section provides tips and strategies for navigating an EB-5 visa denial and reapplying successfully.

Common Reasons for EB-5 Visa Denial

Denials happen for a variety of reasons, but being aware of the most common causes can help you prepare a strong application. Here are the top reasons why EB-5 visas are often rejected:

Insufficient Job Creation Evidence:

USCIS requires proof that your investment will create at least 10 full-time U.S. jobs. If the business plan or economic projections fail to clearly show how this will be achieved, the visa may be denied.

Source of Funds Issues:

Investors must prove that their investment capital was obtained legally. If there are gaps in financial records or incomplete documentation, USCIS may question the legality of the funds and deny the application.

Incomplete or Inaccurate Documentation:

Failing to submit all required documents or providing inaccurate information can lead to delays or denials. USCIS requires extensive documentation for the investment, the business plan, and personal financial history.

Ineligible Investment Type:

USCIS has strict guidelines on what qualifies as an eligible investment. If the investment does not meet the requirements or is not in a Targeted Employment Area (TEA) when claimed, the visa may be denied.

Strategies to Appeal an EB-5 Visa Denial Decision

If your EB-5 visa is denied, don’t panic—there are ways to appeal the decision or address the issues raised by USCIS. Here are the key strategies to consider:

- Request Reconsideration or Appeal:

You can file a Motion to Reconsider or a Motion to Reopen the case. These motions allow USCIS to re-evaluate your case, either based on new evidence or because the original decision was based on incorrect facts.- Motion to Reconsider: Request USCIS to review the decision based on the law, arguing that their decision was incorrect.

- Motion to Reopen: Submit new evidence that addresses the reasons for the denial.

Tip: Work with an immigration attorney to prepare a strong case for reconsideration or appeal.

- Administrative Appeals Office (AAO):

If the motion to reopen or reconsider is denied, you can escalate the case to the AAO, which reviews immigration-related appeals. This process can take time, but it’s an option if you believe your denial was unjust. - Address Specific Denial Reasons:

Review the denial notice carefully to understand exactly why your application was denied. Address each specific issue directly, whether it’s related to job creation, source of funds, or business viability.

Tip: If the denial was due to incomplete documentation, gather the missing information and submit it promptly during the appeal.

Reapplying for the EB-5 Visa After Denial

Sometimes, it’s better to reapply for the EB-5 visa rather than pursuing an appeal. Here’s what to keep in mind when reapplying:

Correct the Original Mistakes:

Review the reasons for the initial denial and make the necessary adjustments in your new application. For instance, if the denial was due to insufficient job creation projections, strengthen your business plan with more robust data and expert opinions.

Choose a Stronger Investment:

If your initial investment didn’t meet USCIS standards, consider selecting a new regional center or direct investment with a proven track record of EB-5 success. Regional centers with a history of job creation and approved visas can significantly improve your chances.

Improve Documentation:

Ensure that your source of funds documentation is comprehensive and thoroughly vetted. Missing or incomplete financial records are a common cause of denials, so this should be a top priority when reapplying.

Final Thoughts on the EB-5 Visa

The EB-5 Visa can be a powerful opportunity for investors to obtain U.S. residency, but it requires careful planning, a solid investment, and thorough documentation. While the visa offers significant benefits—such as permanent residency and potential U.S. citizenship—there are risks involved, especially if the investment fails to meet USCIS requirements.

Is the EB-5 Visa the Right Path for You?

- Yes, if:

- You have access to the required capital investment.

- You prefer a direct path to U.S. residency for you and your family.

- You are willing to commit to job creation through either direct investment or a regional center.

- No, if:

- You prefer a smaller investment and more flexibility in business management.

- You are not ready to comply with the strict USCIS requirements regarding job creation and source of funds.

Latest News.

From the blog

-

- Posted by Alvez

-

- Posted by Alvez

"*" indicates required fields