How to Form a Company in the U.S. as a Non-Citizen or Non-Resident

With unique business ideas and the

passionate people behind.

Introduction to U.S. Company Formation for Non-Citizens

Starting a business in the U.S. as a non-citizen or non-resident offers exciting opportunities. The U.S. has a welcoming structure for foreign entrepreneurs, whether you’re looking to start an LLC or a corporation. However, understanding the benefits, challenges, and processes is crucial to forming your company smoothly.

Quick Setup

Fast and efficient U.S. company formation tailored for non-citizens.

Compliance Help

Expert guidance on U.S. tax and legal requirements.

Full Support

End-to-end services, including EIN registration and bank account setup.

Market Access

Gain credibility and tap into the U.S. market with ease.

Can Non-Citizens Start a Business in the U.S.?

Yes, non-citizens and non-residents can legally form a company in the U.S. You don’t need to be a U.S. citizen or have a green card for U.S. company formation or establish an LLC or a corporation. Here’s how it works:

- Limited Liability Companies (LLCs) and Corporations are open to anyone, regardless of residency or citizenship status.

- Foreign entrepreneurs can own and operate a U.S. business from abroad.

Example: A software developer from the UK can start a U.S.-based LLC to sell their software in the U.S. without residing in the country.

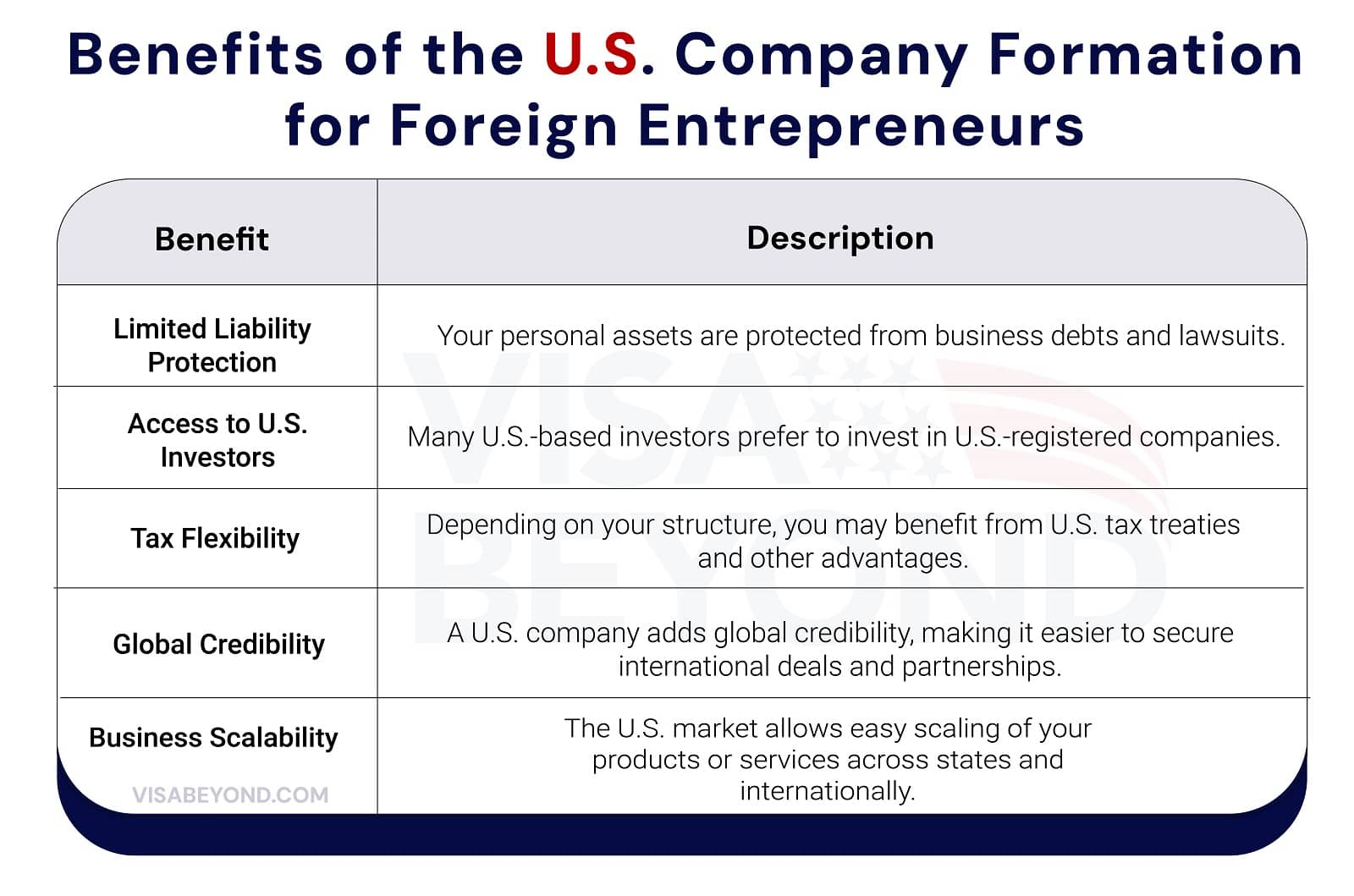

Why Form a Company in the U.S. as a Non-Resident?

There are several advantages to U.S. Company formation as a non-resident:

- Access to the U.S. Market: The U.S. is one of the largest and most diverse markets globally, offering vast opportunities for growth.

- Reputation and Credibility: Having a U.S. company can enhance credibility with investors, partners, and customers.

- Access to Capital: U.S.-based companies have better access to U.S. investors, including venture capitalists and angel investors.

- Limited Liability Protection: LLCs and Corporations offer personal liability protection, meaning your personal assets are not at risk if your company is sued or incurs debt.

Example: A tech startup from Germany forms a Delaware C-Corporation to raise funding from U.S.-based venture capital firms.

Benefits of the U.S. Company Formation for Foreign Entrepreneurs

Forming a U.S. company as a non-resident opens access to the world’s largest economy, providing credibility, access to U.S. markets, and the ability to establish U.S.-based bank accounts. It also offers potential tax benefits and easier access to U.S. investors and business partnerships.

Example: An entrepreneur from India establishes a Wyoming LLC for an e-commerce platform to sell products globally, benefiting from U.S. credibility and easier logistics with U.S. customers.

Types of U.S. Business Entities for Foreign Entrepreneurs

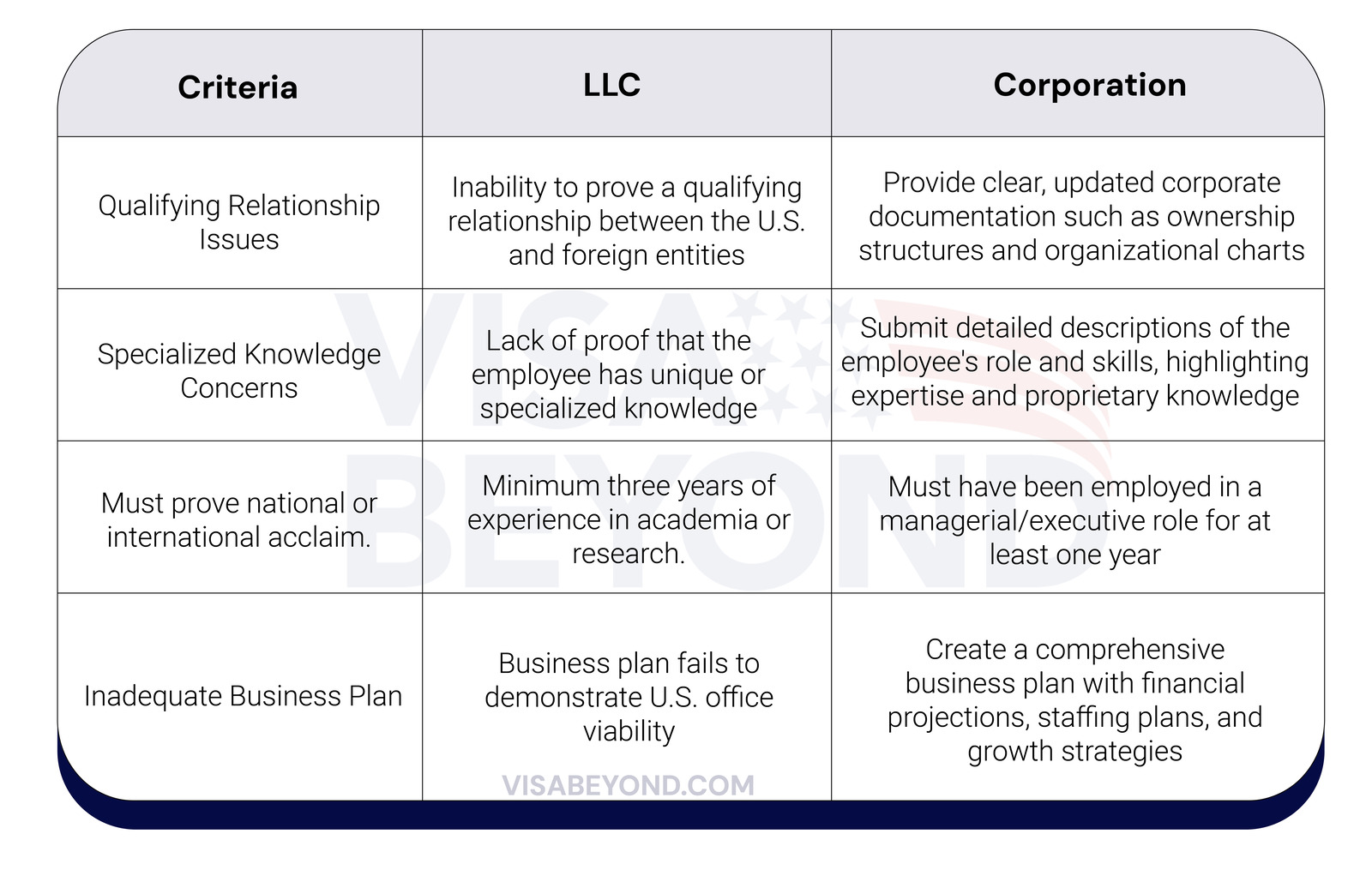

Foreign entrepreneurs have several entity options when forming a business in the U.S. The two most common structures are Limited Liability Companies (LLCs) and Corporations. Each has its benefits and drawbacks.

Choosing Between an LLC or Corporation

Foreign entrepreneurs have several entity options when forming a business in the U.S. The two most common structures are Limited Liability Companies (LLCs) and Corporations. Each has its benefits and drawbacks.

When deciding whether to form an LLC or a Corporation, consider the following:

- LLC: Best for flexible management, pass-through taxation, and limited liability.

- Corporation: Ideal for raising capital through stock issuance, offering a more formal structure with stricter compliance requirements.

Example: A solo entrepreneur from Brazil may prefer an LLC for its simplicity and tax benefits, while a startup looking to raise capital may opt for a C-Corporation.

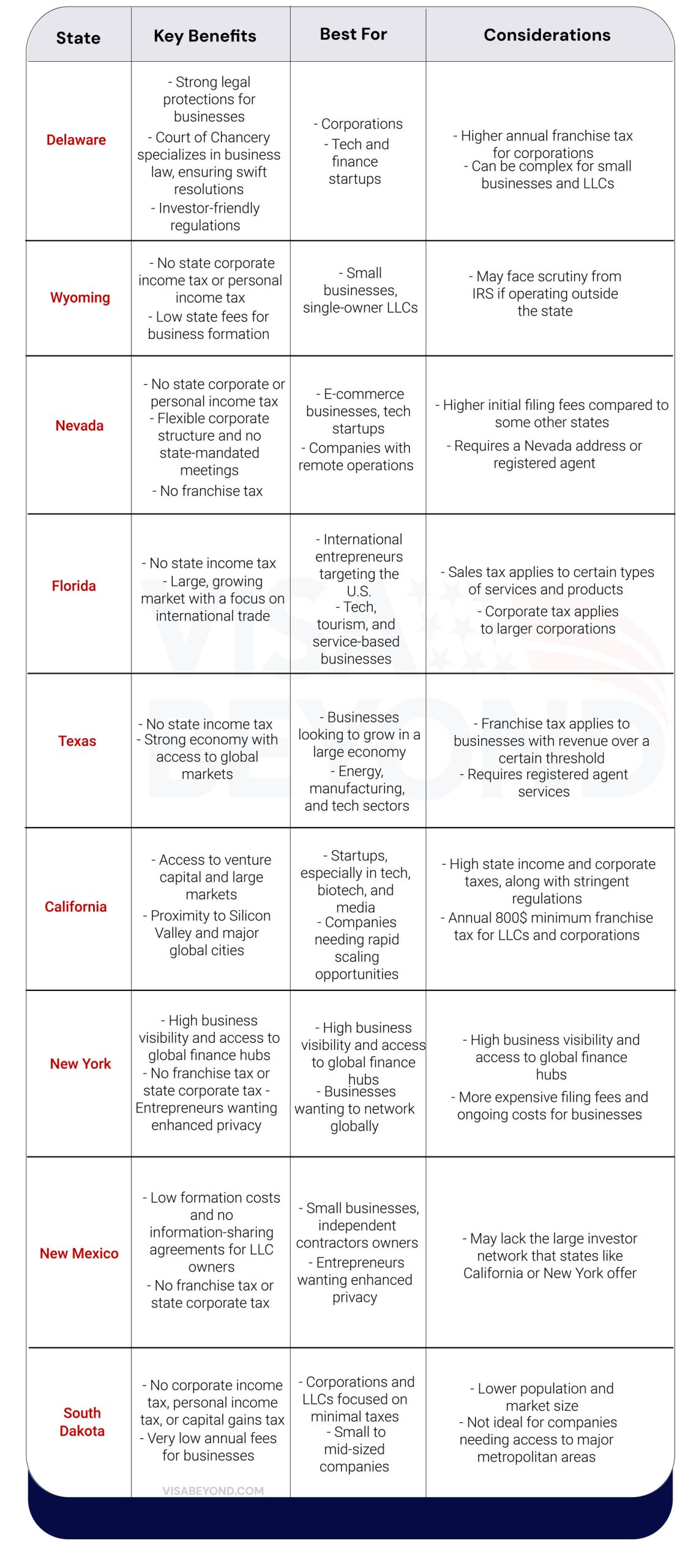

Best U.S. States for Forming a Company as a Non-Citizen

Some U.S. states are more business-friendly for non-citizens and non-residents, offering tax benefits, lower fees, and fewer reporting requirements. The top states include:

Benefits of Forming an LLC for Non-Residents

Forming an LLC offers several advantages for non-residents, including:

- Simplified Taxation: LLCs are taxed as pass-through entities, meaning profits are reported on your personal tax return (unless taxed as a corporation).

- Ownership Flexibility: There are fewer restrictions on ownership and profit distribution in LLCs.

- Fewer Formalities: LLCs are not required to hold annual meetings or maintain detailed corporate minutes.

Benefits of Forming a Corporation for Non-Residents

For non-residents looking to raise capital, a corporation offers distinct advantages:

- Ability to Issue Shares: Corporations can raise capital by selling shares, making it easier to attract investors.

- Limited Liability: Shareholders are not personally liable for the debts of the corporation.

- Corporate Structure: A more rigid structure can appeal to investors and venture capital firms.

Example: A biotech startup from Israel chooses to incorporate in Delaware as a C-Corporation to raise venture capital from U.S. investors.

Step-by-Step Guide to Forming a U.S. Company as a Non-Citizen

Here’s a step-by-step guide to help you navigate the process of forming a U.S. company as a non-citizen.

Registering Your Business in the U.S.

The process of forming a company in the U.S. involves several steps:

- Choose Your Business Structure: Decide whether to form an LLC or a corporation.

- Select a State for Formation: Choose a business-friendly state such as Delaware, Wyoming, or Nevada.

- File Formation Documents: Submit the necessary formation documents to the state (Articles of Organization for LLCs or Articles of Incorporation for Corporations).

How to Choose Your U.S. Business Name

Your business name must be unique and comply with the state’s naming rules. Here’s how to choose the right name:

- Check Availability: Use the state’s business name search tool to ensure your desired name is available.

- Compliance: Ensure the name includes required designators (e.g., “LLC” or “Inc.”).

- Trademark Search: Perform a federal trademark search to avoid conflicts.

Filing Formation Documents for LLC or Corporation

When forming a business in the U.S., you must file formation documents with the state in which you are incorporating. Here’s how to do it for both an LLC and a Corporation:

For an LLC:

- File Articles of Organization: This document includes your LLC’s name, registered agent, business address, and member information.

- State Filing Fees: Fees vary by state, typically ranging from $50 to $500.

For a Corporation:

- File Articles of Incorporation: This document outlines your corporation’s name, number of shares, registered agent, and details about the board of directors.

- Corporate Bylaws: Although not always filed with the state, corporations must draft bylaws outlining how the company will operate.

Let’s Make Your U.S. Dreams a Reality.

U.S. Taxation for Non-Citizen Business Owners

Understanding U.S. tax obligations as a non-citizen is crucial to avoid fines and ensure compliance with U.S. tax law.

How U.S. Taxes Work for Foreign Entrepreneurs

Foreign entrepreneurs with U.S.-based businesses are subject to federal taxes on income earned in the U.S. Depending on your business structure, you may face double taxation unless you plan carefully.

Key Points:

- LLCs: Taxed as pass-through entities, meaning profits are reported on the owners’ personal tax returns.

- Corporations: May be subject to double taxation, meaning both the corporation and shareholders are taxed.

Federal Taxes vs. State Taxes for Non-Residents

There are two types of taxes that foreign entrepreneurs need to consider:

- Federal Taxes: Paid to the IRS on profits generated by the business. The federal corporate tax rate is 21%.

- State Taxes: Some states (like Texas and Florida) don’t have a corporate income tax, while others (like California and New York) do.

How to Avoid Double Taxation as a Non-Resident

To avoid paying taxes twice (in both the U.S. and your home country), non-residents can:

- Claim Tax Credits: Use foreign tax credits in your home country to offset U.S. taxes paid.

- Check for Tax Treaties: Some countries have tax treaties with the U.S., allowing reduced tax rates or exemptions.

Filing IRS Form 5472 for Foreign-Owned U.S. Companies

Foreign-owned U.S. companies must file IRS Form 5472 if they have reportable transactions between the U.S. company and its foreign owners. This includes capital contributions, loans, or reimbursements. Failure to file can result in fines up to $25,000.

Managing a U.S. Company from Abroad

Managing a U.S. company as a non-resident involves careful planning and the use of trusted service providers.

Can You Run a U.S. Company Remotely as a Non-Resident?

Yes, non-residents can manage their U.S. company from abroad. Many tasks, such as managing finances, overseeing operations, and communicating with clients, can be done online. However, a registered agent is still required to manage legal correspondence within the U.S.

Appointing Managers or Directors for U.S. Companies

Corporations must appoint directors to oversee the company. LLCs can appoint managers to run day-to-day operations. Non-residents can serve as both managers and directors.

Handling Business Compliance and Legal Obligations Remotely

Non-residents can use service providers to ensure their U.S. company remains compliant with state and federal laws. This includes filing annual reports, paying taxes, and maintaining a registered agent.

Do You Need a U.S. Visa to Operate a U.S. Business?

No, you don’t need a U.S. visa to own or operate a business remotely. However, if you plan to physically work in the U.S. or engage in day-to-day operations within the country, you may need a visa, such as an E-2 Investor Visa.

FAQs About U.S. Company Formation

Do You Need a U.S. Address to Form a Business?

Yes, most states require a U.S. address when forming a business. However, you don’t need to personally reside in the U.S. to fulfill this requirement. Instead, you can hire a registered agent who will provide you with a U.S. address for official documents.

Do Non-Citizens Pay U.S. Income Taxes on Business Profits?

Yes, non-citizens must pay U.S. income taxes on profits earned by their U.S. company. LLC owners pay taxes on their share of the business profits, while corporations pay corporate taxes at the entity level.

What type of business entity is best for non-citizens?

- The most common choices for the U.S. company formation are LLCs and C-Corporations. LLCs are simpler and provide flexibility, while C-Corporations are ideal for startups seeking venture capital or expanding operations globally.

Do I need a U.S. address to form a company?

Yes, you need a registered agent with a physical address in the U.S. to receive official correspondence on behalf of your company.

How do I get an EIN for my U.S. company?

An Employer Identification Number (EIN) is required for tax purposes and can be obtained from the IRS. We can help you apply for an EIN, even if you don’t have a Social Security Number (SSN).

Visa Guidance

We provide personalized advice on selecting the right U.S. immigration visa based on your specific goals, whether it’s for employment, investment, or family-based immigration, ensuring that you meet all the necessary requirements for a successful application.

Documentation Support

Our team assists with preparing and organizing all necessary documents, including visa applications, sponsorship letters, and supporting evidence, to ensure a smooth and efficient process while avoiding common errors or delays.

Legal Assistance

We offer continuous legal support throughout the entire immigration process, including responding to requests for additional information, handling any visa-related issues, and advising on pathways to permanent residency or citizenship once you’re in the U.S.

We help to achieve

mutual goals.

Latest News.

From the blog

-

- Posted by Alvez

-

- Posted by Alvez

-

- Posted by Alvez

"*" indicates required fields